By Thomas Hawkins | September 15, 2021

In a 9/13/21 Employee Benefit Research Institute (EBRI) webinar (The Impact of Proposed Legislative Changes on Retirement Income Adequacy), EBRI Research Director Jack VanDerhei presented an analysis of pending legislative changes, including automatic contribution plans and arrangements (ACPAs), paired with a refundable saver’s credit.

In a 9/13/21 Employee Benefit Research Institute (EBRI) webinar (The Impact of Proposed Legislative Changes on Retirement Income Adequacy), EBRI Research Director Jack VanDerhei presented an analysis of pending legislative changes, including automatic contribution plans and arrangements (ACPAs), paired with a refundable saver’s credit.

This latest EBRI analysis was particularly timely and relevant, since both ACPAs and a refundable saver’s credit are included in the 9/7/21 retirement-related budget reconciliation proposal by the House Ways & Means Committee.

Unsurprisingly, EBRI projects that these two high-profile retirement savings policy initiatives would deliver significant benefits – which VanDerhei characterized as having a “huge impact on reducing retirement deficits” – particularly for younger age groups. However, what was surprising was the sheer magnitude of incremental benefits delivered by the addition of auto portability to those initiatives, significantly paring retirement shortfalls for 35–39-year-olds, across all race and ethnicity categories.

About the Analysis

In addition to modelling the impact of ACPAs and a modified saver’s credit, EBRI’s analysis also examined these initiatives in combination with other policies not presently on the legislative docket, including:

- Employer student loan “offset” contributions.

- A “skinny 401(k)” – a deferral-only 401(k) plan that allows annual contributions up to $6,000, with annual catch-up contributions of $1,000, after age 50.

- Auto portability, a new plan feature that automatically moves participants’ retirement savings forward following a job change.

Interpreting the Results

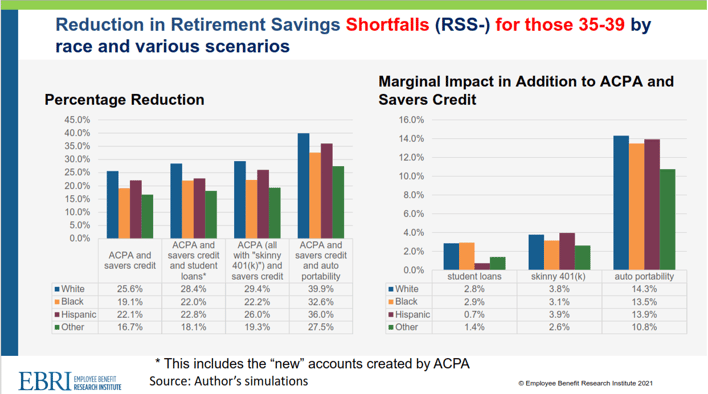

EBRI’s summary findings indicated that ACPAs, when paired with an enhanced saver’s credit or “match” would drive huge reductions in retirement shortfalls for 35–39-year-olds, ranging from 17 to 26 percent, depending on race. VanDerhei further noted that those policies would have an even broader impact, when households who are not simulated to have a retirement deficit are considered.

Turning to the addition of other policies, VanDerhei remarked that either of the employer student loan contributions or a “skinny 401(k)” could add “another 4 percent reduction in retirement deficits.”

Addressing auto portability, VanDerhei characterized it as “the real big kicker on top of the ACPA and saver’s credits. We find that if you add auto portability to that, you get another 11 to 14 percent reductions in retirement deficits, depending on race” – bringing the combined, total reductions for ACPAs, the saver’s credit and auto portability to a whopping 28 to 40 percent.

These findings were illustrated later in the webinar by the EBRI diagram shown below.

Source: EBRI Webinar, 9/13/21 (The Impact of Proposed Legislative Changes on Retirement Income Adequacy)

Connecting the Public Policy Dots

In a prior article (Beware of Unintended Effects of Retirement Savings Public Policies), I wrote of the need to consider the unintended, or second-order consequences of retirement savings public policies. I expressed my belief that the dramatic expansion of workplace retirement savings plans, while delivering significant benefits, could also result in increased cashout leakage as well as an increased incidence of missing participants and forgotten accounts. In that piece, I also suggested that auto portability could serve as a complementary policy initiative that would mitigate those effects, and in so doing, deliver incremental benefits.

EBRI’s analysis now seems to confirm that view. In fact, it seems that no other policy option even comes close.

1916 Ayrsley Town Boulevard

1916 Ayrsley Town Boulevard